ECJ on VAT treatment of supplies of equipment and dies

On 23 October 2025, the ECJ has commented on the VAT treatment of supplies of tooling equipment with reference to the legal case Brose Prievidza C‑234/24.

Underlying case

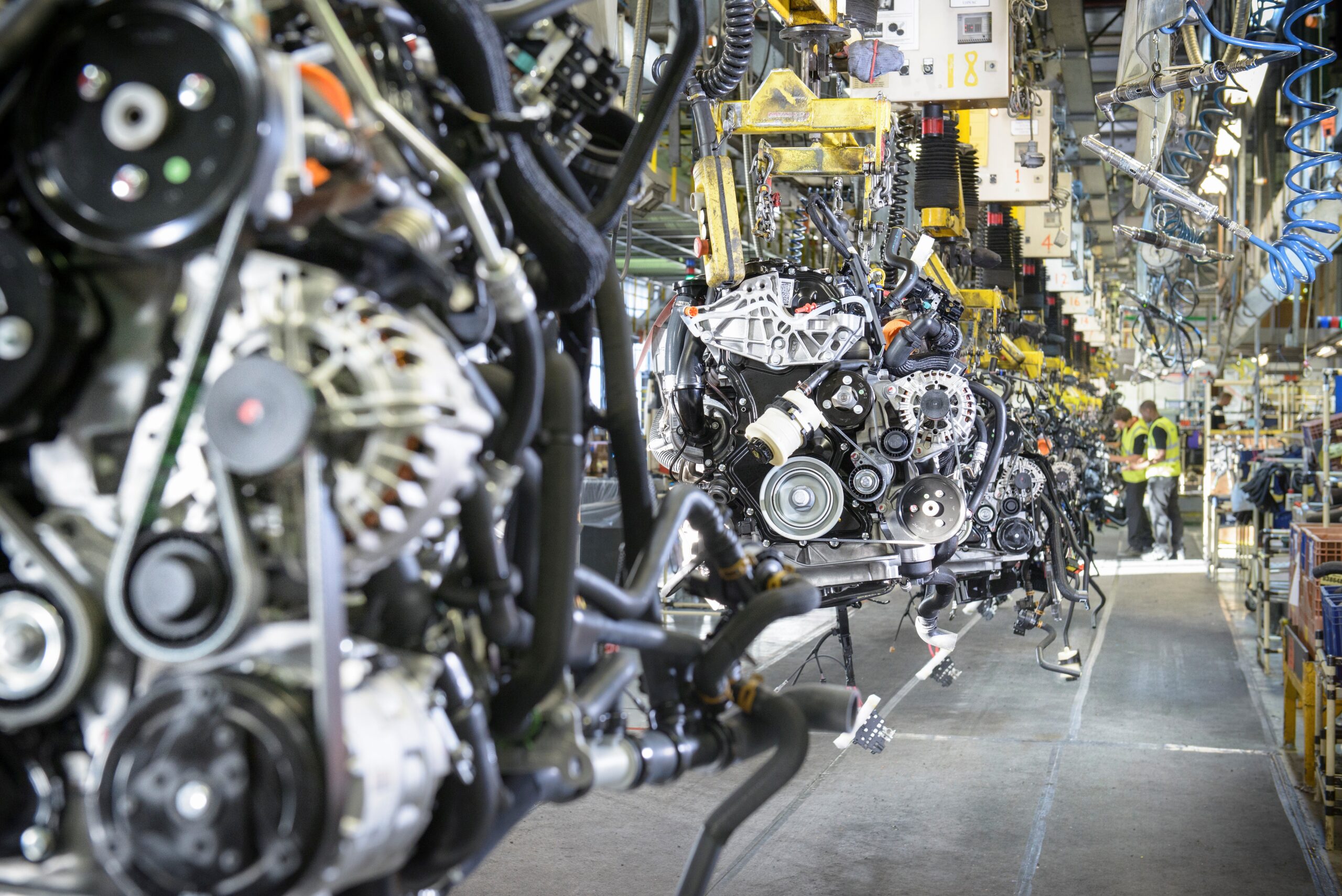

The German automotive component manufacturer Brose Coburg acquired specific tooling equipment from the Bulgarian supplier IME Bulgaria for the manufacture of components and sold it to the Slovak company Brose Prievidza at a later time. The tooling equipment has remained with IME Bulgaria in Bulgaria, which uses it exclusively to manufacture the abovementioned components intended for Brose Prievidza. The components manufactured with this equipment were supplied directly to Brose Prievidza by IME Bulgaria and were sent from Bulgaria to Slovakia.

Due to the lack of physical movement of the tooling equipment, the supply was treated in Bulgaria as taxable local supply subject to VAT. Brose Prievidza applied for a refund of that VAT paid by Brose Coburg in Bulgaria. That application was rejected by the Bulgarian tax authority giving the reason that the supply of the tooling equipment was ancillary to the VAT exempt intra-Community supplies of the components manufactured using the tooling equipment and the transactions had been artificially split.

The matter in dispute was whether the supply of the tooling equipment and the supply of the therewith manufactured components are to be classified as a single supply from a VAT perspective. A single supply exists when both transactions are so closely linked that they form, objectively, a single, indivisible economic supply, which it would be artificial to split, or when the supply of the tooling equipment is to be classified as a non-independent ancillary supply to the supply of the components manufactured using the tooling equipment.

ECJ decision

The ECJ clarifies that a prerequisite of a VAT-exempt intra-Community supply of goods is that the goods are physically supplied to another Member State.

In the specific case, the ECJ rejects both an artificial split and the existence of an ancillary service and qualifies the supply of the tooling equipment and the supply of the components manufactured using the tooling equipment as independent supplies of goods. The following aspects were decisive:

- The tooling equipment was supplied by a different service provider than the components manufactured with them. As the Advocate General observed, it is correct to treat supplies of goods provided by different independent taxable persons separately for VAT purposes.

- The fact that tooling equipment is not intended to produce a single part or a single batch of parts, or to be integrated into the components, but is intended to be used for serial production, can contribute to showing that the supply of that tooling equipment is not “closely linked”.

- The supply of the tooling equipment has an independent economic purpose for the recipient, such as securing production resources, transferability and reducing dependencies, especially in the event of supplier insolvency.

- An artificial split did not exist based on the economic and commercial reality. As part of the group’s business model, equipment orders were placed centrally within the group at Brose Coburg and at the time of ordering, the group entity which must produce the parts is not known.

Notes on Austrian practice

In Austria, supplies of tooling equipment are generally treated as non-independent ancillary supply to VAT-exempt export supply of goods or intra-Community supply of goods, provided the conditions in margin note 1106 VAT Guidelines (UStR) are met. According to this, a non-independent ancillary service is present in particular if:

-

- the power of disposal over tools, models, and equipment remains with the domestic taxable person (manufacturer), who ships them to the third country or, analogously, to another EU Member State after fulfilling the order; or

- the power of disposal passes immediately to the foreign acquirer, but this is clearly only intended to prevent use for orders from other entrepreneurs.

It remains to be seen whether these principles also apply to cases where tooling equipment is supplied as part of a chain transaction. The case underlying the ECJ ruling is in any case not comparable to the scenarios in margin note 1106 UStR. In the Brose Prievidza case, the acquisition of the tooling equipment was made centrally through a group company, which resold the tooling equipment within the group. This company, which centrally managed the purchase of the tooling equipment, was not involved in the purchase of the components manufactured with them.

It remains unclear according to the ECJ’s view under which criteria a non-independent ancillary service would be conceivable if both the tooling equipment and the parts manufactured with it are supplied by the same service provider. It remains to be seen how the Austrian tax authorities will respond to the decision and whether they will restrict the current position in the UStR. Any possible adjustment could take effect for future cases from a specific date.